Your Guide to Working on the Road

The pandemic changed how a lot of us work.

Maybe you were already working from home or had to quickly make the switch when the pandemic began. A lot of employees are going back to the office now, but companies have decided to make some remote positions permanent.

Although working remotely was a challenge for a lot of people at first, they’ve adjusted and are maximizing their work-from-home life. Some employees are taking their work on the road, traveling occasionally or full-time.

Many of us at OpMentors love to take our work on the road. We’re sharing some lessons we’ve learned along the way if you’re thinking about traveling while you work too.

1. Purchase a Wi-Fi hotspot.

When you’re working remotely, access to the Internet is a necessity. Most Airbnb spots and hotels have complimentary Wi-Fi. Campgrounds usually have Wi-Fi too, but it’s not always reliable.

Although service can still be spotty, having a hotspot is your safest bet for Internet access. A lot of cell phones have hotspot capabilities, but using your cell phone quickly drains your battery. With a hotspot, you’ll have access to Wi-Fi without using your phone’s battery or data, and you can purchase as much data as you need for your workload.

2. Pack extra chargers if you’re camping.

Access to a power source is another must when working on the road. Make sure you take all of your chargers, and it never hurts to pack extras.

Like Wi-Fi access, power supplies can be limited. Invest in battery- or solar-powered chargers. You can also save battery life by using devices that require less energy. For example, tablets or smartphones use less energy than laptops so work on those when you’re able. Decreasing the brightness on your screen or closing apps you’re not currently using also saves energy on your devices.

3. Schedule your time.

When you’re working on the road, the world is your oyster (or the landlocked parts of it anyway!). With so many possible adventures to take, this lifestyle requires some self-discipline and structure.

You must schedule your time so you’re completing your tasks for work while maximizing your time at each stop along the way. Make sure you have a good system for tracking projects and meetings and make a to-do list every morning before you start your day. You’ll also want to use a calendar to keep up with your check-in and check-out days at each location.

4. Download recommended apps for weather updates and navigation.

Weather can change quickly so you’ll want a backup plan if you’re camping or driving long distances. Make sure you have a good app for weather updates — we recommend Storm Shield!

You’ll want a good navigation app like Google Maps too. iExit is also a great app for finding upcoming exits for gas stops, rest stops, and restaurants. We also recommend sticking to the highways if you’re towing a travel trailer or motorhome. Trust us — we have stories!

5. Find a Salesforce event near you.

While you’re sightseeing, don’t forget to also look for opportunities for vocational growth and connection. Salesforce offers events around the country like Trailblazer Community Groups or Dreamin’ Events easily found online.

Although working on the road has its perks, it can also be lonely. Events that offer opportunities for networking and growth allow you to connect with and learn from others in your industry.

Working on the road takes some getting used to, but these tips will help you make the most of the experience! Remember, our team is always here to help you on your journey to becoming a successful business too. Schedule a call today, and let’s talk about how we can optimize Salesforce and FinancialForce for your business no matter where you are.

Ask These Questions before Using ERP Software

With enterprise resource planning (ERP) software like FinancialForce, you know life will be easier soon for you and your team.

But where do you start?

FinancialForce has so many offerings to get your back office running efficiently, but it’s hard to know what processes and optimizations to tackle first.

We understand. We ask our clients some basic questions to determine which steps to take first in their ERP journey, and today we’re sharing them with you! They’ll help you know what to prioritize when optimizing ERP software for your business.

1. What are the pain points in our processes for delivering a service?

A pain point is a recurring problem that inconveniences or frustrates your employees or customers.

We know any organization will always have bumps along the way, but dream with us a moment — what would your “business utopia” look like? In other words, what pain points would be absent? Now, grab a pen and paper and jot those down.

Pain points are what you want to address first when beginning your journey with ERP software.

Frequent pain points for our clients include low visibility into resourcing, utilization calculations, and project financials. You’re also probably frustrated if all of your data is in separate spreadsheets instead of one unified system.

When you identify your pain points, you know what to prioritize when optimizing your ERP solution.

2. Who will utilize this software and what’s their bandwidth for learning a new ERP solution?

Learning a new ERP solution like FinancialForce requires time and dedication. We recommend identifying an expert from each department who’s familiar with its subject matter and processes. They should also have the margin in their schedule to learn the ropes of a new system.

The department experts you choose should be able to understand and articulate 1) the company’s vision for implementing the new tool and 2) its goals when optimizing the solution for its processes.

Their feedback will be vital during the phase of analysis, which occurs right before you roll out the new solution in your organization. They will be the best people to refine these processes before they’re finalized, and you’ll also want them to measure and report the benefits and growth thanks to your new ERP solution.

3. What high-impact problems do we need to address with our new ERP software?

We’re not talking about pain points that frustrate employees and customers when we ask clients this question. We’re talking about glitches in your organization’s processes that cause major problems like revenue leakage or profit erosion.

Once you identify the inefficient processes affecting your bottom line, you’ll know which ones to tackle first when implementing your new ERP software. Do you need to shorten the billing cycle for projects or track project financials with greater precision? Are price lists and vendor inventories regularly updated? Do you need more accuracy when it comes to the time employees track on projects? Do you need to improve utilization rates?

You can’t address every high-impact problem when getting started with a new ERP solution, but asking these questions will help you identify and focus on the major issues first. If you choose to work with OpMentors and make a list of these problems, we’ll help you create a roadmap for addressing them in the order that makes sense for your company.

4. How will you handle management changes within your company?

Changes in management are inevitable, and learning a new system takes a lot of time and effort until your team gets the hang of it. Before you roll out your new ERP software, you should ask this question so you’re prepared when changes in leadership take place.

Last week we told you about our new partnership with Spekit! We’re creating “speks” for FinancialForce and implementing them with our clients. Speks offer contextualized, in-app information — like detailed definitions, training videos, and additional instructions — about various objects, fields, and topics!

Speks are a great way to quickly onboard and train new employees. Read last week’s blog here to learn more.

5. How will you evaluate the success of your ERP solution?

Learning and implementing a new ERP solution requires a lot of hard work, and you should celebrate your success! But first you must determine how you’ll measure that success.

What would “success” look like for your company? How will you document your return on investment and small victories along the way?

After investing in FinancialForce and a little help from OpMentors, many of our clients tell us their finance and services teams save a lot of time and energy now on manual reporting. Because all of their data is in one place, their profits increased, and they’re able to make decisions with confidence about the future of their company.

When you’ve always done things one way, implementing new ERP software like FinancialForce can be overwhelming. Asking these 5 questions will relieve some pressure and get you started on your ERP journey. OpMentors is always here to help you answer these questions too and get your ERP solution up and running. Schedule a call today, and we’ll work through these questions together and make FinancialForce work for your organization.

OpMentors Is Creating Speks for FinancialForce (and for You!)

We’re familiar with the frustration that sets in when your organization’s data isn’t in one place or different systems don’t talk to one another. We’ve talked a lot about how Salesforce and FinancialForce offer solutions to those problems.

But we also know learning the ropes of a new platform for professional services automation (PSA) like FinancialForce or customer relationship management (CRM) like Salesforce can be overwhelming at first.

Maybe you keep notes in Google Docs about how to perform processes or tasks in your current PSA or CRM platform, but the instructions haven’t been updated in months. You’re also answering the same questions every time a new employee joins your team. Plus, some employees might need to see a video demonstration of how to use or customize a field in FinancialForce while others can listen to instructions and follow them without any visuals.

We have exciting news. You can say goodbye to Google Docs with outdated instructions and slow onboarding processes with new employees.

OpMentors is partnering with Spekit to bring you training content for FinancialForce you can access in the application!

In-application training means faster implementation and streamlined processes when you work with us and when you onboard and train employees in your organization.

Sounds great, right? But how does it work?

Spekit is an application available on the Salesforce and FinancialForce platforms. Users can create “speks” for any object, field, or topic. Because Spekit integrates seamlessly with these platforms, you’ll know there’s a “spek” available anytime you see Spekit’s pictorial mark beside an object or field:

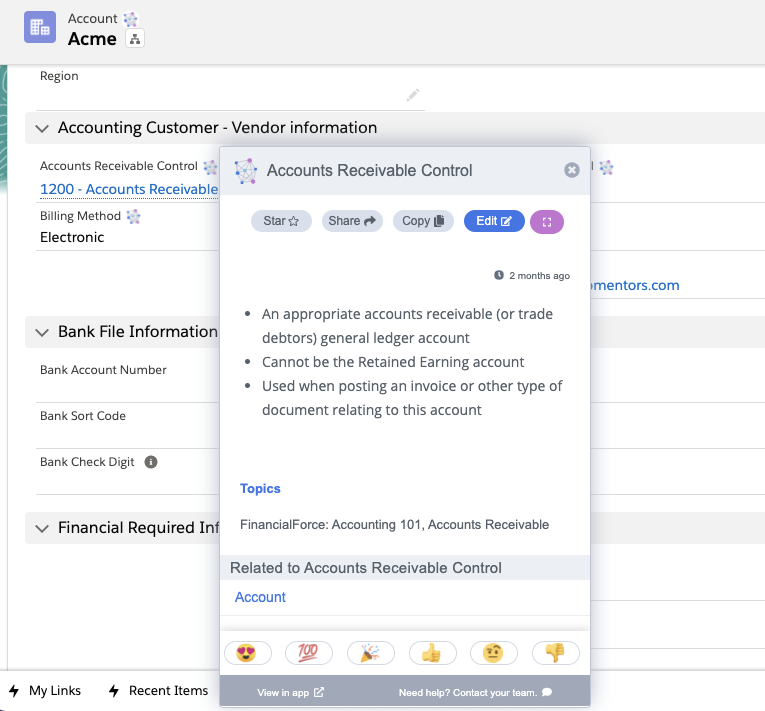

These speks include contextualized, in-app information about these components — detailed definitions and explanations, training videos, and additional instructions:

OpMentors has created speks for two solutions we offer in FinancialForce: Financial Management (FM) and PSA.

If you choose to try out Spekit while working with OpMentors, you’ll get our pre-made Speks for FinancialForce FM and FinancialForce PSA at no additional cost. You’ll just need to pay for licensing to use Spekit, and we’ll help you get started. (Licenses last for one year, and you can renew them as long as you like.) Here are some of the benefits of utilizing Speks while we optimize FinancialForce for your business:

- Decreases implementation time (which saves you money!) because the training tools are at your fingertips

- Increases the time we’re able to spend on customizing FinancialForce for your organization

- Alleviates the frustrations of learning a new system

- Provides notes you can return to as much as you need

- Drives adoption support to get the most from your investment

- Ensures post-implementation support

- Serves different types of learners in your organization

Our partnership with Spekit means you’ll have access to our training documentation long after we’re gone! You’ll also be able to add other pre-built speks or create your own for your business. Here are some other perks for using Spekit:

- Onboard people quicker in your organization

- Share knowledge (Spekit even has a link-sharing feature to send speks to others who don’t have the app!)

- Link speks together using topics (similar to hashtags!)

- Drive revenue

- Prepare for changes within your organization

We’re excited to partner with Spekit to enhance experience working with OpMentors and FinancialForce! Schedule a call today, and let’s talk about how the speks we’ve created can make implementation and training a breeze and enhance your experience in FinancialForce.

4 Ways PSA Software Makes Life Easier

If you’re thinking about investing in professional services automation software (PSA) like FinancialForce, you’re probably wondering if the money and time required to learn the ropes is worth it.

We understand. In our experience, a lot of business owners and leaders like you have a great team. They just need good PSA software that’s optimized for their business to maximize productivity and profit.

FinancialForce can do a lot, but these are 4 of our favorite ways to get the most out of this PSA software (and make life easier on the people in your back office too!).

1. Streamlined Processes and Workflows

Broken processes and workflows are common between the point of sale and service delivery. Why? The back office isn’t getting correct or sufficient data from the front office about new and ongoing projects.

Chances are your services team is experiencing the effects of disjointed workflows if you don’t have good PSA software like FinancialForce or don’t know how to use it.

Because FinancialForce is on the Salesforce platform, you can optimize FinancialForce for your business model and create automations that ensure your back office always has the latest data on a sale while working to provide a service or finish a project.

2. Efficient Resource Management

Your resource manager has an important job. They choose which team members have the time and skillset to complete a project or subtask for a project. They also must consider billing requirements for various clients.

Because resource managers have so many factors to consider, they work within definitive, criteria-driven bounds in order to sufficiently resource a project without costing your organization time and money. But resource requests are often delivered looking less like a detailed request and more like a scratchpad without efficient PSA software.

With FinancialForce optimized for your business, you’re able to refine this process so resource managers can assign jobs to the right employees.

3. Utilization Calculations

Speaking of resources, wouldn’t it be nice to know if you’re getting the most out of your billable resources?

FinancialForce PSA provides all kinds of utilization calculations to measure an organization’s efficiency. Here are some questions FinancialForce's utilization tool can answer:

- Were more hours credited to resources than scheduled?

- Did resources complete scheduled work?

- Were resources assigned enough work?

- Were any resources over-allocated? Were some resource roles under-staffed?

This function provides so many data points. You’re able to view historic, scheduled, and forecasted utilization to make decisions with confidence and ensure optimal performance in your business.

4. Automated Billing Processes

If you don’t have PSA software or your software doesn’t communicate with your customer relationship management (CRM) software, a lot can go wrong between the point of sale and invoice delivery.

With all of this data in one place, billing processes are a cinch.

The ability for resources to log their time in FinancialForce streamlines the billing process because the app integrates with Salesforce CRM. Then you’ll be able to automate billing services, creating an easy handoff to the finance team as to what client should be billed an amount at a specific time.

Optimizing FinancialForce so it works for you requires some time and effort on the front end, but this PSA software will save you time and energy to grow your business. If you’re unsure how to get started, OpMentors is for you. Our team is able to optimize FinancialForce for your business, and we’ll walk with you every step of the way until you’re confident when using your PSA software. Schedule a call today, and let’s talk about how we can help.

5 Salesforce Apps Your SMB Needs

If you’re the owner of a small or medium-sized business (SMB), you know it’s not easy to balance the priority tasks and demands of an SMB with limited time, resources, and employees.

We’ve been there.

We understand you might face unique challenges in operations and informational technology, but you’re succeeding and growing your business anyway. That’s no small feat!

Still, certain apps available on the Salesforce platform can make life easier for you and others in your organization. Here are 5 of our favorite Salesforce apps to improve workflows for small and mid-sized businesses.

Breadwinner

Are you using accounting software like Quickbooks along with Salesforce? Do you wish it communicated with your favorite customer relationship management (CRM) platform?

Breadwinner is the app for you. Its bi-directional integration solution lets you connect your accounting software to the Salesforce CRM. Create and view invoices, sales orders, bills, purchase orders, and so much more.

With Breadwinner, generate invoices from anywhere within Salesforce like opportunities, accounts, or any custom object. You can also view financial information in real-time to take action quickly.

Chatter

Good communication among coworkers is crucial for an SMB’s efficiency. Chatter is a social networking tool created for effective collaboration between coworkers and departments.

With this app, people within your organization can instantly send messages, tag people in projects and tasks, and share data and files. Chatter is a great way to improve transparency across departments and accounts.

Conga Composer

Recreating documents and manually entering data for proposals, quotes, and invoices is costing you time and money as an SMB.

With Conga Composer, you can create and edit pre-built templates for frequently used documents. Because the app is on the Salesforce platform, you’ll eliminate any manual data entry since the data is already in your CRM, streamlining your organization’s documentation processes.

PandaDoc

This app also allows you to create documents on the Salesforce platform, but PandaDoc takes documentation a step further by sending and tracking agreements within Salesforce between you and your clients.

You can send and sign documents from anywhere in the world, creating a more expedient, user-friendly experience for your customers.

Because Salesforce automatically updates to reflect any changes in documentation, your SMB will close deals faster and accelerate cash flow.

Zoom

After a yearlong pandemic, you’re probably more familiar with Zoom than you ever anticipated, but did you know Zoom integrates with Salesforce too?

With the app, teams can easily manage sales calls and meetings scheduled with potential customers and clients. Attendees’ information automatically syncs with Salesforce accounts and active history.

With Zoom and Salesforce working together, your SMB will improve its organization and communication so your teams don’t miss a meeting!

As an SMB, we know your time and resources are valuable. We’re confident your organization will improve its workflows by adding these apps to your Salesforce CRM. Schedule a call today if you need help optimizing these apps for your business. We’ll show you how to use these powerful tools to ensure your SMB gets the most from them.

OpMentors Is Treading on Child Trafficking in May

At OpMentors, mastering Salesforce and FinancialForce isn’t the only reason we love helping business leaders like you. Don’t get us wrong: those things are important.

But our clients also have more time, money, and brainspace to pursue their passion.

That’s what gets us excited.

Our clients are doing some incredible work to make the world a better place, and we love any opportunity to support their efforts. This month we’re participating in a fundraiser called Tread on Trafficking for Love146, a human rights organization working hard to end child trafficking and exploitation.

We wanted to give you a peek into what our team is doing in May when we’re not helping you learn the ropes of Salesforce and FinancialForce.

Tread on Trafficking is a 30-day challenge where treaders ask sponsors to support them while they get active and raise awareness and financial support for Love146. We’ve each committed to walking 5 miles every week. Our goal is to raise $1,500 as a team, and OpMentors will match the first $500 we raise!

All proceeds go to Love146. The money will be used to…

- Provide a child recovering from trafficking with holistic care, journeying alongside them for as long as it takes.

- Meet a young person’s practical needs of food, healthcare, and education as they heal.

- Help a victim seek justice against their traffickers.

- Prevent trafficking by helping a child understand vulnerability, spot the signs of trafficking, identify healthy support systems, and learn skills they need to stay safe.

These are just some of many ways the proceeds will be used to end child trafficking and exploitation. You can learn more about the efforts of Love146 at our team’s fundraising page for Tread on Trafficking.

Our team believes physical activity is important for our health, and it’s been a long year inside because of the pandemic. It’s warming up around the country, and we’re all ready to enjoy the outdoors! We’re excited to get active together and raise awareness and support for Love146, a client whose work we’re passionate about.

We’d love to hear from you as we tread on trafficking this month. Cheer us on by tagging us on Twitter, and visit our fundraising page if you’d like to learn more about Tread on Traffic or make a donation. We’re always excited and ready to help organizations like Love146 pursue their passion. If you need mentors in your corner so you can get back to running your business, schedule a call today, and we’ll help you take control of your financials and make decisions with confidence.

Elevate Your Services with Experience Cloud

“I wish we could provide a service like that for our customers.”

You’ve had this thought many times after a user-friendly experience on another company’s website, portal, or application. You’d love to provide services and experiences like these, but you don’t know where to start.

We’ve been there too, and we have good news…

You’re closer than you think with Salesforce and a little help from our team at OpMentors.

Experience Cloud is a social platform powered by Salesforce. With all of your data already in one place, this platform makes it easy to share as much or as little about your organization as you’d like with customers and partners so they can take action.

Salesforce’s Experience Cloud is your one-stop shop to create customizable websites, portals, and apps for different groups of people in- and outside your organization.

Take your services to the next level with Experience Cloud. Here’s how:

1. Build trust with customers and partners.

Think of Salesforce as your company’s home for your data, and now you’d like to give customers, partners, and employees a peek inside. Experience Cloud is a social platform that lets you open a “window” to your home, and you’re in control of the data they see.

People value transparency from a business. With Experience Cloud, you can share data and build trust among different communities.

When you create a portal in Experience Cloud, your customers can view up-to-date account balances and make payments. If you’re a service provider, let customers and partners view the status of a project or approve timecards. Allow partners to enter bills directly into your company’s organization for business-to-business transactions.

With Salesforce’s Experience Cloud platform, you’ll improve communication and transparency and keep people invested in your business.

2. Create multiple communities that meet different needs within a single organization.

Here’s the beauty of Experience Cloud: you can open up as many windows to your home as you like!

Maybe you want to open different windows that serve different communities like customers, employees, departments, investors, and other partners.

You can create experiences tailored to all of these communities within the Salesforce platform.

Provide an effortless onboarding experience for new employees or an Informational Technology (IT) Help Desk that’s easy to navigate. Make your organization’s latest financials accessible to investors. Share status updates for ongoing projects with customers and partners and communicate quickly with them through Salesforce Chatter.

Offer all of these services and more at the same time, in the same place.

Extend the power of your professional services automation even more with FinancialForce’s Experience Cloud (yes, Salesforce and FinancialForce have this capability!). Different communities can quickly access your organization’s data and take action.

3. Choose an Experience Cloud template or build your own.

Maybe you’ve dreamed up the perfect website, portal, or app to build trust with customers and partners, but creating it is way outside your skillset.

Don’t fret: Experience Cloud has templates you can choose from to make your dream a reality.

Select the Customer Service template to answer your customers’ questions and allow them to see what other customers are saying. Make it easier for them to access and update their account with the Customer Account Portal. Use the Partner Central template to streamline processes like proposals or onboarding for new clients.

You can also build your own website, app, or portal using pre-built themes. With a few clicks, provide a customizable experience for different communities while maintaining a consistent look and feel that’s true to your brand.

With Salesforce’s Experience Cloud, the possibilities are endless for serving customers and partners. Not sure where to start? OpMentors is here to help. Schedule a call today, and we’ll walk with you step-by-step to build and launch the perfect user-friendly experience for your organization.

The Faster, More Efficient ERP You're Looking For

If you don’t have good enterprise resource planning (ERP) software, you’re wasting time entering data into systems that don’t talk to one another. In our last blog post, you learned how important it is for your front and back offices to be on the same page about your financials.

Because FinancialForce is built on the Salesforce platform, you get more compatible front and back office software that saves you time and money. We’ve seen FinancialForce slash the time it takes our clients to crunch the numbers for their businesses.

So how does this ERP app work so efficiently?

Your team will work faster with a smaller margin of error thanks to three functions in FinancialForce:

1. View Fresh Financial Reports Every Single Hour

Most Chief Financial Officers only get their hands on an updated financial statement every 24 hours. When you finally see the latest numbers, you might not have the best picture of your business because you’re using an accounting system that doesn’t communicate very well with Salesforce or another customer relationship management (CRM) service.

Wouldn’t it be nice to see your company’s financial statement in real time?

FinancialForce is as close to real-time as it gets. With an hourly sync, you’ll always see the most up-to-date financial statements throughout the day.

The app is also built on the Salesforce platform, which means you get a 360° view of your business because your customer’s data is in one place. Front office data from Salesforce feeds into back office data from FinancialForce, making your financial statements more dynamic and accurate.

With updated data about your finances available every single hour, you’ll be able to make fast financial decisions with the confidence you need.

2. Save Time With Automated Collection Emails

Are you tired of losing time and money on manual collection emails? Do you have a disjointed email system between business operations and collections?

FinancialForce offers a way to automate and streamline emails from initial invoices to overdue balances. You’re able to customize when clients receive invoice notifications. 5 days ahead of the due date? Yes! 15 days late? No problem. You can create emails for billing contracts, subscription billing options, and sales invoices for ongoing projects.

You can also stop manually emailing every customer about their remaining balance. On the accounts receivable (AR) side of FinancialForce, you’re able to automate reminders about outstanding balances or payments past due.

The degree of automation is up to you with FinancialForce. Your financial team will be able to focus their time and effort on other tasks once collection emails are taken off their plate.

3. See Multi-Currency, Multi-Company Transactions In One General Ledger

If you have different books and systems for different accounts, you’re likely working with general ledgers (GL) disconnected from one another.

What if you could consolidate them into one GL?

FinancialForce is able to consolidate all of your transactions into a single GL. A key component is its ability to handle multi-currency, multi-company transactions.

Use the same set of revenue and expense accounts with FinancialForce’s multi-company feature. View an entity’s financial statement in its home currency and automate any currency revaluation.

Say goodbye to manual work and Excel spreadsheets for tracking multiple companies and currencies!

We know your team will work more efficiently with less room for error using these capabilities in FinancialForce because they’ve worked for us. We let FinancialForce crunch the numbers so we can pursue our passion… which is helping you optimize these functions for your financial team! Schedule a call with OpMentors today, and we’ll help you dramatically reduce the time you spend on financial reports.

FinancialForce: The Missing Link You Need

Your front office is thriving now thanks to Salesforce. You’re able to see your customers’ data, and you can manage every touchpoint your business has with them.

But your back office is struggling. There’s no streamlined process for day-to-day operations, making it difficult for employees to collaborate across departments. You’re losing revenue because of manual billing. You’re fearful of financial losses because you don’t have the analytics to make data-driven decisions about the future.

Did you know FinancialForce is an ERP application built on Salesforce to get your back office up and running smoothly? We’ve experienced firsthand the power of FinancialForce, and we want to share what we’ve learned with business leaders like you.

Here are 3 reasons you should get excited about FinancialForce.

1. Get a 360° view of your business.

If you don’t have FinancialForce, then you’re using an accounting system that doesn’t sync or communicate with Salesforce very well (if at all!). Maybe your employees use multiple spreadsheets for internal business processes like expenses, projects, inventory, and billing. Such a disjointed system is costing you time and money.

FinancialForce is the missing link between your front and back office.

FinancialForce is an application created to work on the Salesforce platform, which means it communicates seamlessly with Salesforce, letting you manage your business in one place. Sounds amazing, right? FinancialForce has different modules for business operations like project management, accounting, billing, and revenue. It’s also customer-centric, streamlining the communication and processes between your front and back office.

2. Manage projects with ease and efficiency.

Your team isn’t reaching its full potential without the right project management system. Some of your employees might be overworked while others need more responsibilities. Hours spent on projects aren’t always tracked. Poor project management is a major source of revenue leakage and margin erosion.

FinancialForce’s project management system gives you a clear picture of a project’s “burndown,” which predicts if a project is trending correctly or going over budget.

What’s even better? Retrieving a project burndown report takes only seconds with FinancialForce. You’ll be able to see a project’s hours budgeted, charged, planned, and unplanned. With FinancialForce, you can also balance assignments so you’re utilizing your entire bench. When your teams are on one system, everything from project development to billing is streamlined, leaving less room for error.

3. Make decisions with confidence.

Making decisions about the future keeps you up at night when you’re unsure about the accuracy of your finances. You’re in the dark about your business’s financial health because different departments are working in isolation with different spreadsheets and data.

We’ve been there.

FinancialForce not only provides a single solution for back-office efficiency, but also has powerful analytics so you’re able to see the financial health of your business.

You’ll get an accurate overview of your business so you can take risks and implement changes in your organization with confidence. FinancialForce’s Analytics is powered by Salesforce Einstein so you can make data-driven predictions and decisions that grow your business. You’ll have more brain space to pursue your passion when FinancialForce takes the guesswork out of analytics.We know learning a new system can be overwhelming. That’s why we started OpMentors. Our team knows how to make FinancialForce and Salesforce work for any business. We’ll walk with you step by step until using these tools becomes second nature to you. Schedule a call with OpMentors, and let’s take your back-office operations to the next level.

Meet Machell and Jocelyn: Your Salesforce Success Mentors

“What would you do if you were not afraid?”

Machell and Jocelyn were in the audience when a speaker at Dreamforce 2013, a conference for Salesforce users, asked this question. They discussed it for several days before they had their answer.

“Machell and I were working at a company where we leveraged all aspects of Salesforce and FinancialForce,” Jocelyn said. “We fell in love with the power of the platforms. Our conversations at the conference quickly turned to the fact that we had harnessed this power to build an incredible solution, leading our previous company to go paperless (that was a big deal in 2013!) and grow in sales and revenue without scaling the back office.”

In 2014, Jocelyn and Machell started OpMentors. They wanted to share what they’d learned with business leaders like YOU and take the guesswork out of using these platforms. Machell also enjoys getting to know you personally.

“Understanding our clients’ goals and role in the business is the focus,” she said. “But I truly get excited to learn about their families, hobbies, and pets. Then I look forward to diving into what has compelled them to consider a new solution. Having walked in their shoes helps me connect with them and tell them there’s a light at the end of the tunnel.

Jocelyn and Machell know learning a new system like Salesforce or FinancialForce is overwhelming at first. They started OpMentors so you don’t have to do it alone.

“Having a mentor is a must have,” Jocelyn said. “There’s so much you can do with the power of the two platforms. Having a mentor to guide what should be done is invaluable. If people don’t have the right mentor, then they can get themselves into a muddy, murky mess.”

Jocelyn’s favorite part about working for OpMentors is when you’re finally able to see the “big picture” of your business.

“I get most excited when clients ‘light up’ because they can truly get an overview of their data without asking their team for a lot of data input.”

When they aren’t working, Jocelyn and Machell enjoy the outdoors. Jocelyn, her husband, and their dog camp a lot (their dog has been to 37 states!). Machell likes to fish, and she and her husband even owned a bait and tackle shop in the past. She said that business taught her to share in the ups and downs of customers when running a business.

“Celebrate their successes,” Machell said. “Everyone wants their picture with the ‘big catch’ on the board for all to see. Also, share in their disappointment over ‘the one that got away,’ and provide potential solutions for landing a fish the next time.”

Machell and Jocelyn truly believe in the potential of Salesforce and FinancialForce for your business. They get excited when business leaders like you thrive. With OpMentors coming alongside you every step of the way, you can use these platforms and make decisions with confidence.