Meet Nik Panter: Your Expert in Salesforce Evolution

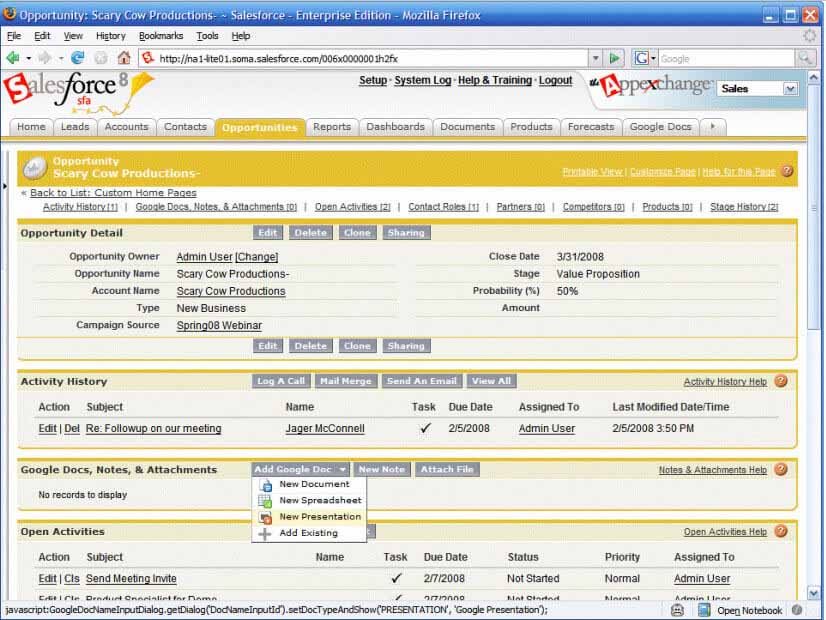

Salesforce launched its Lightning Experience user interface (UI) in 2016. Longtime Salesforce users will recall its forerunner: Classic UI. But OpMentors Senior Director of Delivery Nik Panter has been in the Salesforce ecosystem long enough to remember the “pre-classic” UI — in fun, he calls it the “Jurassic Edition.”

“I still remember when the new Classic UI came out,” he said. “Much like with the Classic-to-Lightning migration, it was hard to let go of a familiar interface, but the new UI truly improved things.”

Have you ever wondered how Salesforce has adapted to the constantly changing demands of customer relationship management (CRM)?

Nik is the perfect mentor to answer that question. He’s been in the Salesforce ecosystem since 2006, and Salesforce was founded only 7 years before in 1999!

His years of experience bring a lot of insight to our tight-knit team, and he’s seen a lot of change. For Nik, one of the biggest evolutions in Salesforce has been the CRM platform’s UI design.

“As everyone in the Salesforce space has seen,” Nik said, “the Lightning Edition of Salesforce has really become the standard over the past few years, taking over for the Classic Edition. This new interface has some amazing features and benefits for end users while also improving the underlying architecture.”

One of Nik’s favorite changes in Salesforce has been its growing list of offerings. If you’re familiar with Salesforce, you’ve probably seen its Customer 360 solution set with the CRM’s current offerings. Its solution set in 2006 looked a lot different:

“When I first started my Salesforce journey,” Nik said, “the application was a traditional CRM: Sales Cloud functionality with a dash of marketing management, service-and-support management, reporting, and custom applications to augment your solution through the AppExchange.”

In 2006, “the cloud” wasn’t even a frequently used term in the tech world, and the average Internet speed through DSL was 1 MB per second. Since then, Salesforce has added to its list of offerings. Partners like FinancialForce, which we also implement and optimize for clients, have also come aboard.

“The growth has been amazing to be a part of.” Nik said. “It’s been awesome to watch Salesforce become not only an innovative leader in software as a service (SaaS) through Salesforce automation, but also a corporate solution set for companies small and large.”

Salesforce has obviously figured out how to scale their company since 1999. When asked what business leaders like you can learn about scaling from Salesforce’s business model, Nik said technical innovation was at the “center of their growth.” A willingness to adapt to technological changes is a key to your business’s success today.

But he also said they invested a lot into Salesforce Ohana, a support system for employees, customers, partners, developers, and members of their communities. This system is a good example to follow when scaling your own company.

“It’s hard to have a company that focuses on putting the customer first if they did not do it themselves,” Nik said. “At Dreamforce, Salesforce co-founder Parker Harris has hosted a session called ‘True to the Core,’ which allows the user base to get answers to their questions from Mr. Harris and his team… That focus not only on the key business leaders and stakeholders, but also on the newest end users has helped Salesforce grow.”

Nik is eager to continue his Salesforce journey and joined the OpMentors Ohana — a Hawaiian word for family! — earlier this year. He and the rest of our team are always eager to help leaders like you maximize Salesforce and FinancialForce in your own companies. Schedule a call today, and let’s talk about how you get the most out of these solutions.

What We're Thankful for in 2021

If you’re like us, you’re probably wrapping up your workday and tying up loose ends before you leave for Thanksgiving. But your mind is already on all of the items on your grocery list that you will need to cook your favorite dish or your grandmother’s stuffing and pumpkin pie you’ll enjoy tomorrow.

In honor of Thanksgiving, our team wanted to do something different this week. Today we’re sharing what we’re thankful for about Salesforce and FinancialForce!

Most of us are grateful for the new functionalities from FinancialForce’s Fall 2021 release. If you haven’t explored them yet, we’re telling you what we like best to give you ideas about where to start.

So take a break from your to-do list and learn about our favorite Salesforce and FinancialForce features in 2021 before heading out to enjoy a scrumptious Thanksgiving feast.

Our 2021 Thanksgiving List

“I am thankful for the flexibility and endless possibilities of the Salesforce platform, which easily allow me to adapt processes as our company grows, our clientele diversifies, and consumer behavior shifts.”

Jessi Timmons

Sales Operations Manager

“I am grateful for the efficiencies and trust in data integrity achieved with FinancialForce solutions.”

Machell Enke

CEO & Co-Founder

“After having a chance to demo the new FF Datastream, I'm pretty excited about finally having a replacement for the older reliable XL Loader that doesn't seem to have quite as many quirks.”

Annette Tarabini

Consultant

“I’m thankful for Salesforce Inbox. We work in Salesforce and Gmail all day, and Inbox allows me to be even more efficient with my time. I’m able to use email templates to quickly send emails without rewriting the same email over and over. Recipients can also choose times for meetings based on my availability instead of playing the back-and-forth game to find a great meeting time. After sending an email, I’m also able to associate the email right into Salesforce with the person(s) and object it needs to be stored on.”

Nik Panter

Director of Delivery

“I'm thankful for the new FinancialForce PSA Resource Request process, which uses Lightning, components, and general functionality.”

Christina Douglas

Consultant

“I am thankful for the automation tools the Salesforce platform provides, especially Flow, which is an incredibly powerful tool!”

Jocelyn Fennewald

CSO & Co-Founder

What Salesforce and FinancialForce capabilities are you most thankful for this year? Tell us in the comments below — we’d love to know!

Happy Thanksgiving from our team! We’re always here to help if you’re ready to implement these features in your business. Schedule a call today, and let’s talk about how we can get your business up and running on the top cloud solutions for your front and back offices.

FinancialForce Introduces Game Changer for Service Companies

FinancialForce just made life a lot easier for you if you’re in the services industry.

In mid-October, FinancialForce announced its newest addition to its Professional Services Cloud: Services CPQ (Configure, Price, and Quote). With Services CPQ, you’ll be able to create estimates more accurately and quickly since all of your data is on a single platform.

Service companies often create initial estimates in a spreadsheet instead of a PSA tool or project management solution. These estimates usually don’t include pricing based on scrupulous resource planning, such as a person’s billing rates, specialized skill set, or availability for the project.

Once the opportunity is closed, estimates transferred from the front office to the back office — or from a spreadsheet to a PSA system — are vulnerable to all kinds of errors. At Diginomica, Brian Sommer explains why this can be disastrous for your business: “If sales people didn’t use firm standards in preparing estimates, the delivery team gets stuck with a deal that it struggles to understand or can’t be delivered at that price, timetable, or team composition as proposed. Handoffs are deadly.”

Not anymore with Services CPQ. Because it lives on FinancialForce’s Professional Services Cloud, there’s no duplication of data or need for integration. All your data is in a single solution, streamlining the process between initial estimates for opportunities and project delivery.

CEO of FinancialForce Scott Brown said, "Services CPQ enables our customers to deliver accurate estimates, complete with resource demand, that create a tight handoff between sales and service and facilitate delivering services projects at scale."

How Services CPQ Works

According to Enterprise Times, Dan Brown, CTO and Strategy Officer at FinancialForce, said the creation of Services CPQ was easier than expected because FinancialForce PSA already performed many of the functions needed for an estimation tool like Services CPQ. Project templates easily translated into estimation templates, and FinancialForce PSA already quantified items like risk and contingency for a project.

“The thing that we do best is being able to connect the Sales Cloud, the opportunity, and account management, with estimation, and then be able to connect that to the subsequent project and resource management and delivery end to end,” Brown said. “This is about digitising and having a fantastic experience, from an opportunity to Bill, all the way through to revenue recognition.”

How does Services CPQ work? With the new addition, you’ll be able to create estimates quickly from a library of templates you’re able to customize and curate. These estimation templates include resource requests and tasks pulled from FinancialForce PSA. According to FinancialForce, Services CPQ also includes “capabilities for ‘what if’ scenario modeling of resources, expenses, and margin requirements using existing rate cards.” Final estimates also connect directly to the opportunity in Salesforce CRM or CPQ, depending on your company’s preference and needs.

Services CPQ is a game changer for service companies. You’ll be able to:

- Deliver tighter estimates quickly

- Close opportunities fast and jumpstart projects faster

- Provide the most compelling estimates to customers

- Serve employees with more accurate, efficient resourcing

- Increase your company’s revenue

We’re excited about the new possibilities Services CPQ provides for our past, current, and future clients in the services industry. We’re here to help whenever you’re ready to add Services CPQ to your FinancialForce PSA Cloud. Schedule a call today, and let’s discuss our team can help you deliver tight estimates to your customers and increase revenue and employee satisfaction.

The Fastest Way to Maximize Your FinancialForce Investment

FinancialForce offers a wealth of functionality to track your back office’s finances and processes. If you’re new to the system, it’s hard to know where to start.

We shared some questions here your team can ask to determine which functionalities to implement first.

But we’re excited to announce a new OpMentors offering — Service Resource Planning Essentials — where we implement some crucial metrics and capabilities in FinancialForce for you!

We’re partnering with FinancialForce to deliver a results-driving sales cycle with upfront pricing. You’ll get your back office running quickly and efficiently on the top platform for financial management (FM) and professional services automation (PSA) with our guided and proven approach to implementing FinancialForce.

What are SRP Essentials?

We believe some functionalities in FinancialForce PSA and FM are catalytic for maximizing your return on investment in these solutions and transforming your business. That’s why we call them “essentials.” They’re also quick to implement and easy to use.

When you invest in our SRP Essentials offering, we optimize and implement these essentials for you. One of our mentors will also walk with your professional services and finance teams until they’ve mastered them.

The following FinancialForce capabilities are included in our SRP Essentials offering:

FinancialForce Management

- Accounting foundations

- Accounts receivable

- Accounts payable

- Journals, allocations, and fixed assets

- Metrics and reporting

FinancialForce Professional Services Automation

- Project management

- Resource management

- Timecard/expense entry and approval

- Billing

- Metrics and reporting

We implement these FM and PSA essentials rapidly so you maximize your return on investment in FinancialForce and can take action with confidence.

Who Benefits from SRP Essentials?

Our SRP Essentials offering has a fixed fee and fixed scope, enabling out-of-box functionality. We find that SRP Essentials are most beneficial for:

- Businesses needing to get up and running quickly on FinancialForce

- Businesses looking to utilize best industry practices

- Emerging and growing companies

- Budget-focused companies

If your business falls under one of these categories, schedule a call today to learn more about SRP Essentials. Our team is passionate about helping businesses like yours succeed with these FinancialForce PSA and FM capabilities. We’re excited to learn more about your business goals and help you reach them with this new offering.

Your Foolproof Guide for Testing Your Solutions

It’s happened to you or someone you know: Salesforce and FinancialForce are live, and errors and bugs immediately surface and slow progress.

End users don’t have the right data sets and permissions to take action in the company. New employees inherited notes for using the system on a scratchpad. Business leaders are already questioning the amount of time and money spent on these solutions because they seem to be holding your team and company back.

But you can avoid these problems by testing your solutions before your company goes live with them. This critical phase of implementation is called “user acceptance testing” or “UAT.”

Also known as “beta testing” or “end-user testing,” UAT is the final phase of your implementation when optimizing Salesforce and FinancialForce. During this phase, end users “test-drive” the finalized version of these solutions in a separate testing environment before they go live in your organization.

We call this separate testing environment the “UAT sandbox.” Project managers, accountants, business owners, software developers, and other end users “get in the sandbox environment” to make sure the customized version of these solutions meets the unique needs of your business.

This sandbox environment uses a different login URL than your production environment: the environment where your solution is live. This means you can develop and test new functionality without affecting your current system!

This phase of implementation is critical. UAT ensures end users are getting the most out of these solutions and customers are satisfied. Today we’re sharing our step-by-step guide to maximize UAT so you get the best return on your investment in Salesforce and FinancialForce.

Step 1: Decide who will test these solutions in the sandbox environment.

Asking too many end users to be involved in UAT increases the potential for personal preferences and conflict to get in the way of productive feedback.

We recommend choosing one end user from each department who will regularly use the solutions once they’re live.

The less they know about the configuration process, the better! These end users often test the solution more thoroughly. If a customer or vendor will be using the solution, invite one end user to test it — and make sure necessary non-disclosure agreements are in place!

Step 2: Have a plan for testing.

A consulting partner might provide high-level test scripts or test cases, but you still should be deeply invested in your organization’s plan for UAT. In the end, you’re who confirms the solution matches the scope of work and meets the unique needs of your business.

A test script is a “line-by-line description of all the actions and data needed to perform a test,” even down to which buttons to press in which order! Test cases or scenarios are situations the end user might face or problems they must solve. Test cases are more open-ended to ensure the end user can navigate the solution, solve problems, and take action in the production environment.

Creating test scripts or test cases is a lot of work, but you’ll be ahead for future training and onboarding once you’re finished!

Step 3: Make sure end users have the right profiles and permissions.

This step is easy to overlook. End users normally don’t have the admin-level permissions that consulting partners and project team members have in the solutions.

In your UAT sandbox, you’ll want to make sure each profile for end users has access to the data they need to perform test scripts or test cases. They will also need the right permissions and queue membership (if applicable). Having the right permissions ensures end users can view only the data they should see.

Really think about this step because it’s critical if you want buy-in from end users. They will get excited about the solution when they see they’re able to do their job more efficiently with the right data and permissions!

Step 4: Devote time in your organization for testing.

Your company invested a lot of time and money into these solutions so gathering feedback is critical. But end users in your company are busy. Don’t assume they will make time out of their already-busy schedules for UAT. Schedule that time for them!

We suggest also setting up office hours for assistance with your consulting partner or an internal project team member. Communicate that you value their feedback. Then protect their time for UAT so they can give it to you.

Step 5: Decide how you will collect feedback from end users.

Even if you tell end users you value their feedback, they won’t always believe you if you don’t make it easy for them to share their UAT experience. Invite end users to submit their feedback in a trackable system like Trello. Ask them for screenshots or videos too when a bug or error surfaces.

After end users have provided feedback, decide what errors and bugs to fix first. You’ll want to address items in-scope if you’re working with a consulting partner.

You can tackle other items in a subsequent phase or rollout of the solution after the current scope goes live. You might not fix every problem at once, but you’ll have a roadmap for improvement in the future thanks to user feedback.

When done correctly, UAT is the most effective way to reduce the time and cost to fix problems once a solution goes live in your production environment. If you’re still unsure about how to maximize UAT, our team of mentors is here to help. Schedule a call today, and let’s talk about how you can maximize and test Salesforce, FinancialForce, and other solutions before your company goes live with them.

Take the Stress out of Tax Compliance with This Solution

Did you know the United States alone has more than 12,000 state and local tax jurisdictions today? In the last decade, the U.S. had a combined total of 6,066 new or changed sales and use tax rates — an average of 577 every year!

Tax rates and jurisdictions are constantly changing. Manually researching and calculating tax rates for your company is error-prone and costs you time and money. You can avoid these mistakes by automating tax compliance rates with an application called Avalara.

Here’s the really good news: FinancialForce and Avalara have a pre-built connector. As a partner with FinancialForce and Avalara, we’re able to implement this connector for you so the solutions seamlessly communicate.

Here are some reasons we recommend implementing Avalara to transform your business:

1. Avalara lowers your margin for error and audit risk.

Because sales tax rates and jurisdictions are always in flux, making mistakes is easy to do if your team is manually calculating tax rates in disconnected systems or spreadsheets. Errors in tax rate compliance is a huge risk for your business, resulting in lost revenue and even negative audits.

Avalara automates tax compliance rates for your industry and tax type. When you connect Avalara and FinancialForce, you’re able to apply Avalara’s tax codes to different products and services you sell. These tax codes will automatically account for taxation variations in different jurisdictions. The platform also provides tasks to complete each month to ensure you’re always prepared for an audit.

2. Avalara works with FinancialForce to create invoices with accurate sales tax rates.

Like we said, Avalara applies tax codes to your products and services in FinancialForce. This means FinancialForce Accounting will automatically include the correct sales tax for every invoice you send to customers and vendors.

Because Avalara is a cloud computing solution, you’ll get real-time data transfer over a secure connection. Tax compliance rates are updated in FinancialForce in less than one second so you’ll never have to worry whether your ERP solution is up to speed.

3. Avalara Returns automates and streamlines your tax returns.

Filing your tax returns manually — or electronically without efficient software — drains your team’s resources. But filing and paying your company’s taxes is easy with Avalara Returns. This product on Avalara’s platform is scalable to any size business and automates returns preparation, filing, and remittance.

With Avalara Returns, you’ll be able to access information for every jurisdiction where you file taxes in a single dashboard. Since your sales data in FinancialForce already syncs with Avalara, you can file taxes and remit payments with just a few clicks.

4. Avalara gives time back to your finance team for revenue-generating tasks.

Your goal is ultimately to scale your business. That’s difficult if your finance team is spending a lot of time on researching tax compliance rates or manually calculating and entering them into spreadsheets and invoices. Maybe you’ve considered hiring personnel to focus on tax compliance.

Avalara gives you another option. You can save time and money when you outsource this work to a platform built by tax experts and technologists. They’ve put in the time so you don’t have to. Instead, your finance team can streamline tax compliance and focus on other tasks that generate revenue for your business.

Dream a little — what could your team accomplish if tax compliance didn’t consume so much time and money? Avalara offers an affordable, scalable solution for businesses any size, in any industry. If you’re interested in implementing Avalara in your business, schedule a call today. Our team is here to help you get the most out of Avalara so you can take the stress out of tax compliance and focus on growing your business.

What Does a Mentor Do?

You’ve invested a lot in CRM and ERP solutions, and you want to get the most out of them. On platforms like Salesforce and FinancialForce, the possibilities for business transformation are endless, but knowing where to start can be overwhelming and difficult…

...unless you have access to a Salesforce or FinancialForce consultant or “mentor” walking with you every step of the way.

That’s where we come in. We want to help you get the most out of your investment in Salesforce and FinancialForce.

But what does a mentor do? Today we’re giving you a window into what a mentor-client relationship looks like at OpMentors.

A mentor evaluates current processes with your company’s objectives, goals, and pain points in mind.

Business consulting is a mentor’s top priority at OpMentors. We don’t take a one-size-fits-all approach to these solutions because we understand your business has unique objectives, goals, and challenges.

We want to help you grow your business — Salesforce, FinancialForce, and other digital tools are the vehicles we use to do it.

Every day our mentors work to enhance your technology investments so they meet your unique business needs. First, we ask questions about your processes, values, mission, goals, and pain points. This assessment phase helps us determine 1) which challenges we’ll tackle first and 2) what action steps we’ll take next to optimize these tools for your business.

A mentor configures and customizes Salesforce, FinancialForce, and additional solutions for your business.

When you set out to build a house, first you need raw materials. Think of your solution as a house. In Salesforce or FinancialForce, you have access to lots of “raw materials” — fields, modules, and functions. Once a mentor charts a course based on your unique business needs, they build a firm foundation using these raw materials. This process is called configuration.

Adding a field to an object, defining certain values for a given function, or updating a page layout are all a part of configuration, and your mentors use these raw materials to build the perfect “digital house” house for your business.

Sometimes you need functions not included in a platform’s “raw materials.” These functions require additional coding or development. This process is called customization.

A mentor configures and customizes these platforms so they’re optimized for your business.

A mentor creates process flows and tests them before the solution goes live.

Evaluating and fine-tuning your company’s processes is an important part of our work. To ensure streamlined processes, a mentor creates process flow documents and configures Salesforce and FinancialForce so processes and integrations run smoothly.

A mentor tests these processes by playing out multiple scenarios on the platform to check for glitches and make sure requirements are met for functionality.

They also let project managers, business owners, software developers, and other end users in your organization “test-drive” these solutions before they go live! This phase is called “user acceptance testing” (UAT) or “end-user testing” and ensures your customized version of Salesforce and FinancialForce meets the unique needs of your business. A mentor is like an additional team member because they work closely with project managers and others in your organization.

A mentor deploys your solution and walks with you every step of the way until you’ve mastered Salesforce and FinancialForce.

Our mentors deploy all of your configuration and customization items to your “production environment” — a term developers use to refer to the environment where these features and functions will be put to use by end users. In this case, the production environment is your Salesforce or FinancialForce platform. A mentor also helps you migrate all of your existing data to these platforms so you have a 360 view of your business in one place.

Once your solution is live, our mentors don’t let you go at it alone. We walk with you step by step until you’ve mastered these tools. Our mentors aren’t just consultants — they’re great teachers!

A mentor uses different means for teaching you how to maximize Salesforce and FinancialForce for your business. They organize and lead workshop calls with you and other end users in your organization. They also teach you how to use speks: in-app training documentation, explanations, and videos you can refer to long after our journey together has ended! If you want to learn more about our partnership with Spekit, you can read more here.

Our mentors also lend ongoing support to your team and Salesforce or FinancialForce system administrators until you feel confident using these solutions.

With a little help from a mentor, you can master these tools, even if the task seems overwhelming at first. Our team can optimize Salesforce, FinancialForce, and additional solutions so they meet the unique needs of your organization. But if we’re honest, we’re most passionate about the mentoring relationship we’ll build along the way as we work together to transform your business. Schedule a call today, and let’s talk about how OpMentors can walk with you until you’re leading and growing your business with confidence.

Save Time and Money with These Technical Value Adds

You’ve been on the fence about Salesforce or FinancialForce. Maybe you even have the software but haven’t taken the time to learn a new system because it feels overwhelming. You’re wondering if these tools really add more value for your business.

We understand. We know investing in and utilizing Salesforce and FinancialForce is a big decision. That’s why we’re passionate about mentoring business leaders so you get the most out of these digital solutions.

Salesforce and FinancialForce offer several automations and tools that add more value once you know about them. Today we’re sharing 4 of our favorite technical value adds that save you time and money.

1. View data and complete tasks for month-end closes all in one place.

If you’re an accountant for your business, you know the month-end close is a laborious process when your data isn’t in one place.

What if you could view the statuses of bank reconciliations, journals, sales invoices, and payable invoices in a single dashboard on your enterprise resource planning (ERP) software or in your Internet browser?

With FinancialForce Accounting, you can create a “Month-End Close Dashboard” with all of this information at your fingertips so you can review, record, and reconcile account information faster. Team members can also view and complete month-end tasks, and in-application automation will notify others when they’re completed.

2. Create in-application flows to manage projects with efficiency and precision.

Companies lose a lot of time and money after an opportunity closes and a project begins. Miscommunication between sales and services teams or between departments frequently results in unmet deadlines, unnecessary errors, and poor resource management.

FinancialForce professional services automation is (in the company’s own words!) a “cloud-based project management software built on the Salesforce platform,” which means you’ll be able to create a streamlined workflow for a new project once an opportunity is categorized as “Close Won” in Salesforce!

With FinancialForce PSA, you can create a new project and any relevant fields like a project’s account, name, start date, and type. You can also make simple or complex templates to save time on future projects.

Utilizing FinancialForce PSA for project management makes your resource manager’s job a lot easier too. You’ll be able to easily alert your resource manager when a new project is created so they can quickly staff the project.

3. Create status reports with tables and queries that pull and update information from FinancialForce.

After you create a new project in FinancialForce PSA, what if you could generate status reports for the project and send them to employees and clients? Now you can with Conga, an application businesses use to create documents quickly and easily.

Conga partnered with FinancialForce in 2016, and the duo is the perfect solution for sharing project summary reports internally and externally. With Conga, you’ll be able to pull and update project information from FinancialForce like timecard details, milestone progress, project task progress, and risks in a single document.

You can also create templates with your branding for a consistent look. After you’ve created a status report, Conga will generate a PDF to email stakeholders, saving time for you and your team.

People value transparency. With Conga, you’ll be able to keep stakeholders in a project informed on its status while spending more time and energy on projects and less on reporting.

4. Automatically notify team members when an opportunity is closed.

PandaDoc is an app that allows you to create documents on the Salesforce platform, but it takes documentation a step further by sending and tracking agreements within Salesforce between you and your clients. Because Salesforce automatically updates to reflect any changes in documentation, you’ll close deals faster and accelerate cash flow.

But there’s another way PandaDoc adds technical value for your team: once you and another party sign a contract, the app automatically moves an opportunity from the current sales stage to “Close Won” in Salesforce. You can also automate emails to alert team members when deals are closed.

Your team will be able to create workflows in FinancialForce PSA and tackle projects faster with PandaDoc’s streamlined documentation and synchronization with Salesforce.

Once you have Salesforce and FinancialForce, these automations and applications are easy to use and save you a lot of time and money. If you’re unsure how to implement them in your business, our team at OpMentors is here to help! Schedule a call today, and we’ll add these automations and tools to your digital platforms and teach you how to use them.

Salesforce Terms You Need To Know

“Insider” language can be overwhelming when you’re learning about Salesforce for the first time. Salesforce experts talk about customization, communities, objects, and deployment — and sometimes you have no idea what any of those terms mean.

Learning a new system is already daunting without the added frustration of difficult Salesforce terms to remember. To make it easier on you, we’ve written the meanings of some terms we use a lot when working with clients.

Configuration

“Configuration” refers more generally to the arrangement of elements in a given system. Think of your Salesforce platform in its finished form as a house.

You have lots of “raw materials” — fields, modules, and functions — to choose from to build your house. The process of choosing and arranging the “raw materials” to build your Salesforce house is configuration.

Adding a field to an object, defining certain values for a given function, or updating a page layout are all a part of Salesforce configuration. You’re taking the platform’s raw materials to build a digital house.

Customization

You sometimes need Salesforce functions not included in the platform’s “raw materials.” These functions require some additional coding or “development” — this is called “customization.”

People easily confuse configuration and customization. A good rule of thumb to remember is that configuration is standard to any Salesforce implementation. Customization requires additional development to meet the unique needs of your business.

Experience Cloud and Communities

Experience Cloud is a social platform powered by Salesforce. With all of your data in one place, this platform makes it easy to share as much or as little about your company as you’d like with customers and partners.

Remember, Salesforce is like your company’s house where all of your data is stored. Imagine you want to give customers, partners, and employees a peek inside. Experience Cloud lets you open a “window” to your house, and you’re in control of the data they see.

You can open different windows for different “communities” or groups in- and outside your organization. If you want to learn more, check out our blog about Experience Cloud here.

User Acceptance Testing (UAT)

Also known as “beta testing” or “end-user testing,” UAT is the final phase of the implementation when optimizing Salesforce for your business. UAT involves end users at your company “test-driving” the finalized version of Salesforce in a separate testing environment before it goes live in your organization.

We call this separate testing environment the “Salesforce UAT sandbox.” Project managers, business owners, software developers, and other end users “get in the sandbox” during this phase to make sure this customized version of Salesforce meets the unique needs of your organization.

Deployment and Go-Live

“Deployment” is the word we use when referring to the process of taking your configurations and customizations out of the sandbox environment and into the production environment.

“Production environment” might be another new term for you — it’s a term developers use to refer to the environment where their configurations and customizations will be put to use by end users. In this case, your “production environment” is your Salesforce platform.

This means it’s almost go time — or “go-live” time in the Salesforce ecosystem! We define “go-live” as the moment when end users start using Salesforce for day-to-day business operations, such as tracking time or projects, entering milestones, tracking leads and opportunities, and more.

We know the amount of terms to learn in the Salesforce world is overwhelming at first. This blog will help you get started when optimizing Salesforce for your business. Remember, OpMentors is here to help along the way. Our team is passionate about configuring, customizing, and deploying the right digital solutions so you can get back to running your business. Schedule a call today, and let’s talk about how we can make Salesforce and FinancialForce work for you.

6 Ways to Streamline Your Billing Processes

Inefficient billing processes are a major source of revenue losses and cash delays. Billing software that doesn’t communicate well between your front and back offices compounds the problem because your financial data isn’t in one place. Customers are also frustrated by billing portals that make it hard to pay invoices or ask questions.

But we have good news: FinancialForce includes a solution to fill these gaps in your billing cycle from closing Salesforce opportunities to sending invoices and renewing contracts on time.

What can you achieve with FinancialForce’s subscription and usage billing software? The following 6 capabilities of Billing Central will help you increase revenue and give customers a positive experience — even while paying their bills!

1. Unify your front and back offices.

Billing software that doesn’t communicate between your front and back offices leaves your company vulnerable to profit losses. Since FinancialForce is an application on the Salesforce platform, you’ll be able to unify your front and back offices with Billing Central, centralizing even the most complex billing contracts.

A unified billing system like Billing Central decreases the margin for error and increases profits. In fact, FinancialForce users reported a 33-50% improvement in days sales outstanding (DSO) and 50-100% improvement in close times.

2. Optimize billing for different pricing models.

Products, services, and subscriptions require different billing structures. Billing Central allows you to optimize and automate billing processes for product, subscription, and usage-based billing.

You can also use Billing Central for tiered pricing. Imagine you’re a cup manufacturer. You sell 1-10 cups at $10 per cup and 11-21 cups at $9.50 per cup. With Billing Central, you can automate invoicing per tier and track how many cups you sell over a period of time.

3. Consolidate multiple invoices into one.

Do you offer a variety of products and services that require product, subscription, and usage-based billing? What if a customer has several invoices based on different pricing models?

Billing Central makes it easy to consolidate several invoices into one! You can pull billing information from FinancialForce professional services automation (PSA) to combine billing for subscriptions and services. You’ll be able to invoice a customer only once per billing cycle for multiple billing contracts.

4. Create and update contract terms and conditions.

You need a system that can keep up with the evolving needs of your business and your customers. Billing Central allows you to create contracts for product, subscription, and usage-based billing. You’ll be able to adjust or update pricing structures, terms, and conditions quickly and easily for new or existing customers.

Billing Central also makes target invoicing easy so you can create, automate, and send invoices based on a customer’s contract agreement to monthly, quarterly, or yearly payments.

5. Automate taxation rates with Avalara.

Tax rates are always changing. Manually researching and calculating tax rates for billing is error-prone and costs you time and money you don’t have. But you can avoid these pitfalls with Avalara, an application that works with FinancialForce and automates tax compliance rates for your industry and tax type!

With Avalara and Billing Central working together, you’ll rest easy, knowing your tax rates are up-to-date with the latest sales and use-tax jurisdictions on every invoice. Avalara also makes it easier to report and file taxes every year.

6. Provide customers with a user-friendly billing portal.

Good customer relationships are crucial to growing your business. Billing portals that are error-prone and difficult to use are a major pain point for your consumers.

The Customer Billing and Payments Community in Billing Central provides customers with a user-friendly experience when paying their bills. Customers can access account activity, view and print invoices, and make payments — all in one place! The billing portal also works with Salesforce Chatter so you can communicate and collaborate with customers.

These capabilities in Billing Central have made life easier for our clients, increasing their revenue while slashing the time it takes to create and send invoices. Customers are happier too when paying invoices is a streamlined, transparent process from start to finish. Need help optimizing Billing Central for your company’s billing needs? Schedule a call today, and we’ll show you how to make FinancialForce work for your billing structure.